Pitching Your Business Idea - The Complete Guide

See also: Pitching Your Business IdeaWe'll start from the top, to give you some context.

The business world is taken over by the startup movement. For several years now you have heard about unicorns, angels, sharks, VCs, accelerators, hockey sticks and burn rates. It would take a book to cover all these topics in detail. All we need to know for now is that startups are young businesses often utilizing investors’ money to achieve rapid growth.

In the beginning, there’s an idea

Going from an idea for the next big thing to a successful business is not easy. Fortunately, millions of entrepreneurs walked the same path before us, and we can learn from their experiences. The first lesson being:

You don’t need the funding right away. First, validate your business idea.

You’d be amazed how far you can go with no external financing. That gives you the freedom to experiment, refine your idea, and maybe even fail. That way you’ll be more mature when you finally meet investors, so will your idea and your business. Having said that, let’s talk funding.

Preparation Phase

This is probably the most crucial stage.

Facing investors without a serious amount of time of preparing yourself and your deck is heading for disaster.

They will know you haven’t done your homework and, for them, it’s a definite ‘no’.

During this phase you should:

- think your idea through

- create a pitch deck

- create an elevator pitch

- practice your presentation

- do the research on the investor

Sounds like a lot? Not nearly as much as starting and running a company. So, roll up your sleeves and let’s go to work.

Pitch Deck

The great thing about creating a pitch deck is that by doing it properly, you structure your thoughts while analyzing your business idea. And even though the deck is very important, it is only just a summary of your knowledge, crafted for the particular audience.

What do you need first and foremost, then? The knowledge. So, before we dig into sections of the investor presentation, let’s make sure you see it the right way. The goal is not to fill in the PowerPoint. It’s to have these areas thoroughly thought through. After you do that, you won’t need to look at the slides while presenting as they will be merely scratching the surface of what you know.

Section 1: Intro

We’re off to an easy start. Simply put the logo and the name of your company here, add your own name and position (probably founder / CEO) and you’re all set.

Section 2: Business Overview

Important note: At this point, we’re going to introduce the most important tool you need to be using from now on. Namely - empathy.

Imagine you’re an investor. You have some means at your disposal, and you’re meeting a person you’ve never seen before. Probably - one of the dozens of entrepreneurs you’ve talked to this month. They all have an idea they think is worth your engagement. You don’t necessarily share their background, nor have you spent last months of your life working in their startups. So what’s the first thing you need to hear?

You want their idea, condensed. Something short, something catchy, intriguing, something you can instantly understand and relate to. Something you can get excited about.

Now go back to your true self. What’s thrilling about your idea? What analogy describes it best? Don’t go into details here, try to paint the big picture. Get the investor’s attention.

Section 3: Problem

Time to revisit your motivation for releasing a product. Is there an actual problem you are solving? What is it? Describe it in simple words, punctuating user’s pain points. Is the problem pressing enough to encourage people to look for a solution? If not, you may end up creating a gadget: something that, as cool as it may be, does not appeal to a broad audience and ends up on a side lane of history. Or, more probably, you simply fail and go bankrupt. No market need is reason number one why startups fail.

Important note: Focus on user journey. In the end, there is always someone, a person, who is unsatisfied with the current state of things.

Section 4: Solution

How are you going to make people’s lives easier? Tell your idea, but beware, it’s not the time to show screenshots and blueprints yet. Tell the story. Show happy people, whose lives just gotten a little bit better thanks to you. Try to resonate with the investor. The same way he needed to understand people’s pain in the previous section, he needs to feel the relief and joy at this point.

Section 5: Product

Here comes the tricky part. Show your product. ‘But wait,’ - you might object - ‘am I not looking for money to create the product?’ Yes, and no. The truth is, you should have something by now. High fidelity prototypes at the very least or POC vs MVP. But I strongly recommend you create version one of your product before you look for external funding. That will allow you to validate your idea and perform adjustments. Trust me, you will learn plenty just by trying to make your first sale. Use your own money first. If you’re not willing to put your finances at stake, why should the investor?

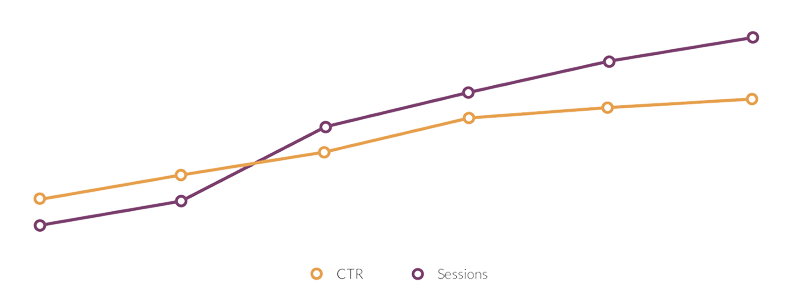

Section 6: Traction

As the common saying goes:

“Traction speaks louder than words.”

What you believe to be true gets very quickly verified by the real world. Sad? Maybe. But it also means that by getting actual traction you get a very strong argument supporting your vision. Do not miss that opportunity. Traction is proof for investors that your business model is viable.

Section 7: Target Market

To be realistic on how profitable your company can be, you need to be aware of your target market. First, create a target audience profile. Then, try to estimate the market size. Get familiar with TAM, SAM, and SOM. Determine if you need a top-down or bottom-up approach.

Section 8: Competition

There are billions of products in the world. You may entertain the possibility that among them there are ones that address the same problem as you do. Does it mean you should give up? Not really.

Very soon you will learn that there are right ways and wrong ways to do things. Maybe you will avoid some of the mistakes that will bury your competition. Maybe you can learn from their mistakes and create something even better? Hard to tell.

One thing is certain, though: pretending there is no competition is never a good idea. Actually, it’s reason #4 why startups fail.

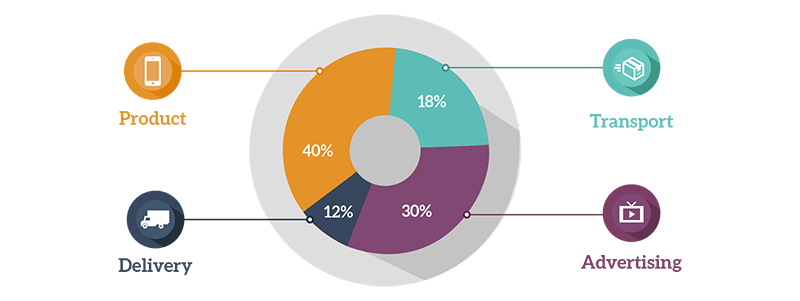

Section 9: Business Model

At this point, your investor transforms. Before, he was also employing the “empathy” tool to see if the product made sense. He was trying to understand end users, their pains, and needs. Right now, he’s a businessman. Keep that in mind. He’ll be willing to give you his money provided he believes you will use them to build a profitable enterprise. The business model shows key components and players and visualizes how the money flows between them. This is one of the crucial points in your presentation. Having great idea is just a start. You need to know how and to whom you’re going to sell it.

Section 10: Plans

Rome wasn’t built in a day. Neither will be your business. Think of the major milestones. Be realistic and conservative. When will you have an MVP ready? When will you achieve the market fit? (not necessarily the same thing!) Who do you need to get there? Finally, how much will it cost? Time and cost will obviously be an educated guess, but the more thoroughly you think it through, the closer you’ll get to actual numbers. Focus on 3–4 year perspective. And don’t throw money around. You don’t need that $200k CEO salary right away.

Be patient, your new Maserati can wait another year or two.

Section 11: Funding

You might be surprised, but simply asking for money is not enough. You need to specify exactly how much you need. Also, the investor will want to hear how much money have been invested in your company so far, how much you’ve spent, current valuation, and — last but not least — what you’re going to do with the funding you get from him. And just to warn you, throwing a big party is not a good answer. You probably should not even joke about it. Running out of cash is - you guessed it - reason #2 why startups fail.

Section 12: Team

Secret #157: An investor does not invest in an idea. He invests in you. Let it sink…

What does it mean? First, that it is very, very important how you come up during the meeting (as if you were not stressed enough already). On the short list of the most important virtues are: integral, passionate but realistic, experienced, knowledgeable, efficient, committed and coachable. You need to have a vision but also stand firmly on the ground.

Second, it means you should surround yourself with smart people. Knowing-it-all is borderline impossible. At the very least, it takes time. Time that can be spent on more important things. Be sure you pick advisors wisely. And most of all - and I cannot stress this enough — put a lot of thought into choosing your partner and co-founder of your business. To scare you some more: the wrong team is #3 on the list of top reasons for startup failure.

Section 13: Contact

Last but not least: be sure to include your contact at the end of your deck. You know, just to make sure the investor knows how to reach you to give you all the money.

Further Reading from Skills You Need

The Skills You Need Guide to Leadership eBooks

Learn more about the skills you need to be an effective leader.

Our eBooks are ideal for new and experienced leaders and are full of easy-to-follow practical information to help you to develop your leadership skills.

Design of your Pitch Deck

… does not come first. Your knowledge does (the deck’s content is a runner-up here). But it doesn’t mean the design is something to ignore. Remember, you’re trying to prove that you’re capable of running a company. Think of your Pitch Deck as a proof of concept. It’s your chance to show you can create a high quality, valuable product that resonates with your audience (in this case: investor).

How exactly should you approach it, then? Be smart about it and trust professionals. Hire a presentation design pro or buy a dedicated presentation template. Do the research and choose wisely. A good template can help you stick to the essentials and present the right amount of information in an engaging way.

Final Thoughts

If you got this far, you must be determined to get your pitch right. That’s a great start. The truth is, you are bound to encounter many challenges. The road lying ahead of you is filled with traps and tedious climbs. That is why my last advice is going to be:

For your startup, choose something you are truly passionate about.

It is proven to be the best way to stay focused, keep your chin up and move forward. Good luck in your venture. Make the world a better place. Next stop - the perfect investor meeting.

About the Author

Olgierd Skibski — former IT Consultant, Motion Designer, Brazilian Zouk Instructor. Currently the CEO of Improve Presentation, company dedicated to helping people communicate their ideas in a beautiful way, creator of the Pitch Deck Presentation Template.